(Part 2 of the Sergio Cecutta interview)

Loz Blain: So yes, a lot of the main players in this industry are starting to list via SPAC. From what I understand it’s not a great deal for investors, compared to a traditional IPO, but there are a significant advantages to the companies. Can you share any perspective on that?

Sergio Cecutta: Well, I wouldn’t say that it’s bad for the investors. It is a different financial vehicle than an IPO. It allows longer-term projections than an IPO. And so it’s a good vehicle for this company, to have access to the type of capital needed to certify.

Aviation is a market that needs significant amounts of investment upfront, and then it takes a long time to recoup the investment. What we found is that SPACs meet this need for these companies to get funding, and at the same time allows them to tell a story that otherwise could not be told in an IPO. IPO is all about historical financials. The SPACs allow them to make projections to 2025, 26, and it lets them basically talk about their story as a company.

That’s why it’s been a vehicle of choice. What has happened is that there’s been extreme exuberance in SPACs, not in this sector but in general, with hundreds of deals. And so the entire sector of SPACs as an investment vehicle is coming under scrutiny by the SEC in the US.

So you would not necessarily consider these things a worse deal for investors than an IPO?

It’s a different financial instrument than an IPO.

Hyundai is an interesting case. Obviously, that’s a company with access to monstrous manufacturing capabilities, and its own source of capital, what do you guys see when you look at Hyundai?

When you look at the investment in these companies, we see a lot of strategic investors, investors that not only bring in capital, but they also bring expertise. For example, Toyota with Joby or Daimler and Geely with Volocopter. In Hyundai’s case, it has taken a strategy to actually go it on its own.

Car companies are seeing two trends conspiring against their automotive business: electrification that brings lower maintenance costs, and autonomy which one day might mean less cars are needed out there in the public. And so these companies are starting to think of themselves as mobility companies, providing a way for their customers to move. It could be a car, it could be a bus, could be a truck, or it could be an aircraft.

Hyundai has entered the market by creating their own division and hiring very good talent in their Urban Air Mobility division. In fact, it’s run by the former NASA Aeronautics administrator, a guy that did a lot of great things at NASA.

So, when I first learned about Hyundai, and later about Joby’s deal with Toyota, my first thought was: both these companies are leading the world in hydrogen fuel cells. Obviously, hydrogen offers a path to a much higher energy density than batteries, which could give eVTOLs much greater range and much quicker refueling stops. Neither of these companies has said anything in public about hydrogen, but since Japan and Korea are focusing so hard on a hydrogen economy, could this be a key advantage for these companies?

There is an interest around hydrogen from the aerospace industry worldwide. There are some companies in AAM that are betting on hydrogen. In Hyundai’s case, I would say that they bring two key strategic advantages. Number one is the knowledge of what it takes to build products in the thousands, or even in the millions.

The other piece is their knowledge around batteries. Because, yes, while aerospace batteries are different than car batteries, they are building and working with them in volume. The Hyundai group is made of multiple brands, they have just announced the first two vehicles built on their new E-GMP platform,a dedicated electric platform that will spawn tens of models throughout their portfolios. And also, a lot of these companies are starting to look at solid-state batteries. That’s another change that will come to this market and it’s of interest to everyone, but we’re not there yet.

As far as I can see your index doesn’t include any hydrogen-specific aircraft. I’m thinking particularly about a company like Alakai Skai. Where would they fit on your list at the moment?

We have not looked at them. We’re adding new entrants every time that we update the index. For the second release we’ve added Dufour and Archer, and we plan to add more in the future. So we just haven’t got to everyone yet.

But the goal here is not to add everyone. If you look at the Vertical Flight Society,it’s like the home of this industry. Mike Hirschberg and all of these guys have done an amazing job. They list over 430 projects from probably over 200 manufacturers. Our goal is not to go through 200 manufacturers at all. There is going to be a long tail of manufacturers that never get off the ground. We want to concentrate on the most promising companies, in order to bring more visibility to the sector.

Volocopter is another interesting company. Seventh on your list, I think. Very short-range vehicles – and obviously that doesn’t really feature in your calculations here, but I think the sort of ranges they’re talking about are 30 to 40 kilometers (19 to 25 miles) on a charge.

This is not a one-vehicle-fits-all market. There might be different vehicles that can cover different markets. Volocopter’s strategy is for typical urban mobility missions. So, something that might not need the range of some of the other aircraft. It’s also one of the few multicopters in the list. But they have agreed with EASA to a certification basis. They’ve been talking around the world to work with Geely in China and other companies. Daimler and Geely are their investors. So they’re doing a lot of good moves. They’re working on all of the aspects of their business.

And Volocopter makes for an interesting comparison with Lilium. Because, as you say, Volocopter’s honing in on a particular use case, which is, you know, one side of a city to another. They’re starting off in Singapore, which is a very, very small geographical area to cover, and probably a great use case for a short-range multicopter that has no efficient cruise mode.

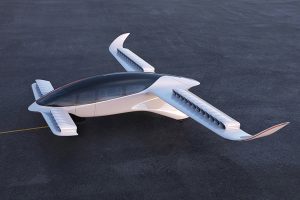

Lilium, on the other hand, is now talking much more in terms of regional, inter-city transport. Their aircraft, with its small-diameter electric fans, has a lower lift efficiency compared with the rest of the class, but it’s low-drag and perhaps more efficient in winged flight, so they want to spend as little time as possible in vertical flight, and they’re not that interested in short, cross-town trips. This is another company that’s been public with their activities for a long time now, one of the early companies on the scene. They have a beautiful aircraft, and they’ve just revealed a seven. What do you see when you look at Lilium?

So, Lilium is making a lot of progress. They have a really strong team across all of the disciplines. Production, certification, engineering, and they are taking all the right steps towards certification. What they have ahead of them is some work to complete the envelope expansion for their five-seaters and then for their seven-seaters. That’s a very important goal for them, and it’s what they’ll be focusing on for the rest of the year.

eVTOLs need to demonstrate three main pieces; the ability to hover, going up and down vertically; the capability to fly horizontally, whether they have wings or not; and the transition between vertical flight and horizontal flight. Some of these companies have already completed the entire envelope. Some of these companies have completed pieces of the envelope, but not the entire envelope and it’s very important for companies to complete engineering tests and flight tests in the entire envelope in order to validate that the vehicle has the performance they’re expecting.

I guess that flight envelope will be pretty similar to a helicopter, right? Maybe some of them go a little faster at top speed, but they should be just as good at handling the low, slow stuff, right down to a stop.

There is a big difference: helicopters are extremely efficient machines in hover. eVTOLs are not meant to hover for extended periods of time. So, for an eVTOL, the hover is a very, very small part of the flight on its way to cruise. Helicopters are built for hovering for extended periods of time, like for example, if you need to look at something. Like a police helicopter that needs to hover and look at suspects. These vehicles can hover, but they’re not made for extended hover times.

And that’s where the multicopter designs lose range, because they have to hold themselves up on power the entire time with no wing lift. But, on the other hand, those guys have a potentially cheaper path to certification, as you say, because they don’t have to do that complex transition maneuver between vertical and horizontal flight.

Again, we won’t know what it means to certify these aircraft until some of them are certified. The first aircraft will open the door to the next ones.

We probably shouldn’t talk through the whole list, I’d be tickled pink but our poor readers have already probably fallen asleep. But I would like to bring up Airbus and Bell, obviously two very well-established aerospace companies, quite low down the list at the moment. Where are these guys lagging behind? What do you think’s happening there?

Mmm. These are companies with enormous portfolios. And while they completely understand the importance of this new market, they have other parts of the business to take care of. In the case of Airbus, the effect of COVID on commercial aviation is definitely something that took their interest. They’re developing a prototype of their CityAirbus, and they want to understand what this space means.

When it comes to Bell, they’re competing for two military contracts, for the FLRAA and the FARAand those are taking a significant amount of time. The FLRAA is the replacement for Blackhawks, so it’s an enormous competition.

Recently, the CEO of Bell said something that was very interesting in an interview. He said, “am I worried about some of these guys (the other entrants in the air mobility industry) that have never certified an aircraft, worried that they’re going to dominate the market? I’m not worried about that at all.”

Bell is sitting on the sidelines, it wants to understand what it takes to certify these vehicles. It wants to see the technology mature. It wants to see batteries mature. And that is the approach of most of the legacy companies: it’s cautious interest, but they’re going to wait.

Interesting. Okay, in a more general sense we’re starting to see dates like 2024, 2025 bandied about as the possible start of commercial services here and there. Do you think these timelines are realistic?

The timeline really depends on the length of time that the certification authorities will required in order to get there. So, I think at this point the answer is, yes, they can make it by 2024. But at the same time, we can’t be completely sure, because certification is not in the hands of the manufacturers, it’s in the hands of the regulatory bodies.

Do you think these things can get up and running without significant infrastructure on the ground, or is that going to have to be a big part of the rollout.

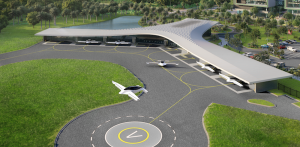

Well, if you if you look at the very beginning, I think the first Uber conference, you saw these skyports, that look like they’re out of Star Wars, enormous. That was Uber just wanting to put out a vision.

I think many of these companies are starting with the understanding that the infrastructure that exists today, is where these companies will start operating. Blade operates helicopters in Pune, Mumbai, Sao Paolo and New York, and in their roadmap they’ll transition to EVAs, or electric vertical aircraft. And the idea here is that they will replace the helicopters with these new vehicles. And they have Beta, with which they’ve signed an order, and now they have Wisk, with which they’ve signed another order.

And so the idea for a company like Blade is to operate between these locations where they already have these heliports. The infrastructure comes in when we want to expand, and, ultimately, if we want to get to the levels of, you know, having thousands of vehicles per city, we definitely need an infrastructure that’s not there yet. But cities around the world are starting to work on it, with different levels of of speed and interest.

I wonder if you could comment as well on some of the projected trip pricing that we’ve been seeing over the last few years, saying that these vehicles are going to be about the cost of taking a ground-based Uber between between two points. Obviously that’s vastly cheaper than helicopters, and that’ll be a massive factor in widespread uptake.

If you look at the financial texts released by the companies that are doing SPACs, they have a lot more information. And getting to the cost of an Uber Pool/Uber X, that’s farther out into the future. They need to have a lot of aircraft flying, they need to have autonomy, and then they can get to these levels. When they enter into service, it might be equivalent to the cost of Uber Black, so you could call it a limo service. The projections vary, but we hear about US$6 a mile at the beginning. But as the service grows, the goal is for the price to come down.

Okay, let’s talk about safety. All I’m hearing from any of these companies is redundancy, and the odd ballistic parachute. So, everyone’s running multiple separate battery packs, multiple flight controllers, and distributed propulsion that can keep you in the air even if you lose a prop or two.

But in the event of total failure, below a certain height, and it’s not an insignificant height, about 120 meters (394 ft), you don’t have time to pop a parachute. Are you aware of any innovation in this area, or is the redundancy concept going to be enough?

I mean, in aviation, we always say that we don’t compete on safety. So, any and all of these vehicles will be certified by the authorities, with the same level of safety that you expect when getting on an airliner. So, when it comes to this, I would say, yes, safety is very important, but safety, it’s something that everyone is working on.

Right, but are redundancy and parachutes the only solutions?

I think every company is looking at safety, according to the vehicle that they’re designing, so I don’t think that there is one solution. But, yes, in aerospace redundancy is very important because it allows you to continue to fly, even if something fails.

I guess with a fixed-wing plane you can try to land it unpowered. With a helicopter you can try to auto-rotate. There doesn’t seem to be an equivalent sort of total failure measure for these for these things, and I was just wondering if you’d heard of anything that that’s coming to fill that space.

What we know is that the cert authorities are working with all of these companies to make sure every one of the aircraft they certify is safe. I don’t think that there’s going to be one silver bullet that applies to all of them, it’s going to be different for each one of the vehicles, but at the same time they’re going to make sure that the public can be confident that getting on one of these vehicles, it’s no different than getting on an airplane at the airport.

Well, it’s been a very informative chat. Let’s keep in touch as the list evolves. It’s such an exciting space, the potential to transform the way we live and get around is enormous. I think people in general are fascinated by by this industry, I know I am, I just think it’s super cool that we’re finally going to get the Jetsons cars! It’s going to change the way that cities look and work, and I’ve already got friends buying houses further out of town on the basis of future eVTOL fast commutes. Obviously, people are moving out of cities as a result of COVID, and lockdowns and I think that plays into the hands of these longer range air commuting companies. So very exciting times.

Technology’s always exciting. I think eVTOLs are bringing back that excitement to aerospace that might have been lacking for some time, so I find it positive.

It’s a good point, yeah, your regular air travel has been so similar for the last 60 years that there hasn’t been much cause for people to get interested. But this stuff is pure sci-fi. When you first see a Lilium jet hovering around you’re just like, oh, this is very different. This is new.

END

(News Source: www.newatlas.com)