The rate of progress in the evolution of the global urban air mobility market is determined largely by the speed with which eVTOLs can be certified for commercial operations. That is, perhaps, one the most misleading of all metrics defining industry progress.

A far better metric would be the number of approvals by national aviation regulators for the content of proposed vertiport emergency response plans – including elements such as the correct mix of liquid/foam and design of the firefighting equipment to manage an eVTOL fire, along with the qualifications to the fire crews to deal with such a fire and the whereabouts of certified training schools able to provide these courses.

Our latest Global Urban Air Mobility Market review of UAM and AAM plans underway in 55 countries and 153 cities and regions around the world indicates that although the number of cities, regions and airports announcing new UAM plans increases each month, the number of countries where regulators and industry are in sync in working on developing an aviation eco-system in which all parts meet or exceed ICAO safety standards remains alarmingly small – five.

A more relevant metric for defining industry progress is the number of eVTOL aircraft and infrastructure manufacturing, operating and support systems and procedures which the national regulator is prepared to sign off on. A requirement to station three fully-qualified crash fire rescue personnel with newly designed equipment needed to fight an eVTOL fire will play havoc with many vertiport and eVTOL business cases, but could well be what the regulator requires.

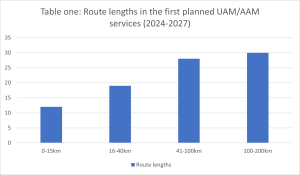

One of the first casualties of the impending national regulatory approval process is likely to be the ambitious lengthy route development plans which eVTOL operators have proposed for the first operations. Of the 89 routes identified for first adoption, 58 are more than 40km in length.

Source: Global Urban Air Mobility database of routes

This is a massive leap from a standing start and hardly in the spirit of the crawl-walk-run philosophy to which industry and regulators have committed themselves. Though it does indicate that inter-urban, rather than intra-urban, services by volume will be the largest segment of the initial AAM market offerings.

There are signs already that the industry is trimming back its initial operating plans to ease the regulatory approval process. When the first commercial routes for the Paris 2024 Olympics were announced, the original plan was for two 20km routes, to the east and west of the city. At the Paris airshow in June, an update to the route network was issued – one 22 km Paris Heliport to Saint-Cyr-l’École (Versailles) route and two new shorter routes: Paris-Charles de Gaulle airport to Paris-Le Bourget airport (16km) and Austerlitz barge vertiport to Paris Heliport (10 km) – plus an undefined number of sightseeing trips.

| A unique insight into AAM/UAM market development trendsOur constantly-updated database of urban and advanced air mobility programmes now lists over 50 country plans and over 150 individual cities and regions, at various stages of developing UAM and AAM routes and vertiports. Subscribers can search the database by route length, eVTOL manufacturer, vertiport developer, airspace integrator and many other criteria, to get a uniquely comprehensive overview of all UAM/AAM development plans in the pipeline by cities and countries around the world, in the short, medium and long term. Sample pages are available here. Also check out our Global AAM UAM Guide to regulations, standards, concepts of operation and roadmaps. |

The first intra-urban services are likely to be shorter and less frequent than many eVTOL operators had planned.

There is another clear trend developing. The global UAM market outside China is being pioneered by countries who have set up a national programme and identified a specific city with a specific timeline for the introduction of eVTOL services. Singapore, Dubai, Korea, Japan and France have all made huge progress in identifying the key stakeholders – from national regulators to local authorities – and their roles and responsibilities within the wider eco-system. Focusing efforts in the way gives industry and regulators a much clearer picture of the granular challenges that will need to be addressed and how all elements of the operational eco-system can be effectively integrated.

(Image:Shutterstock)